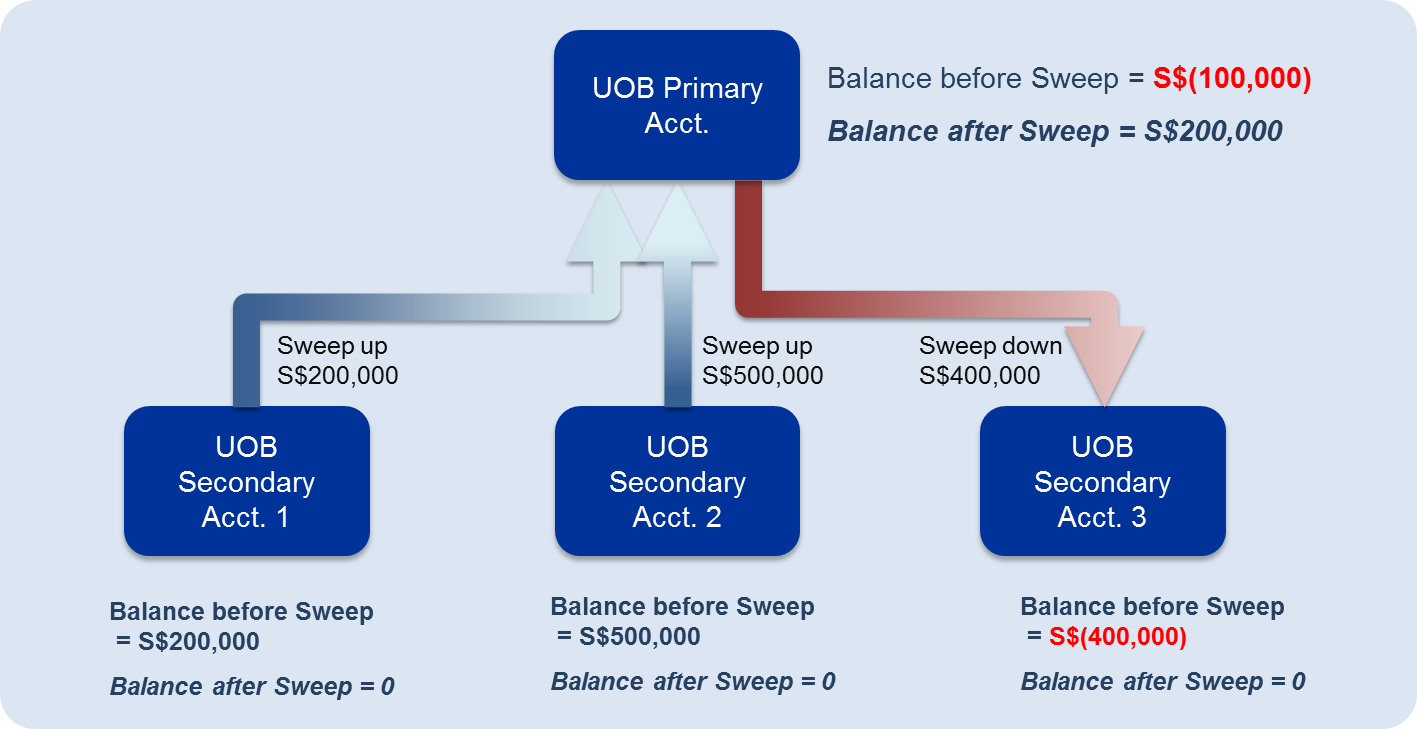

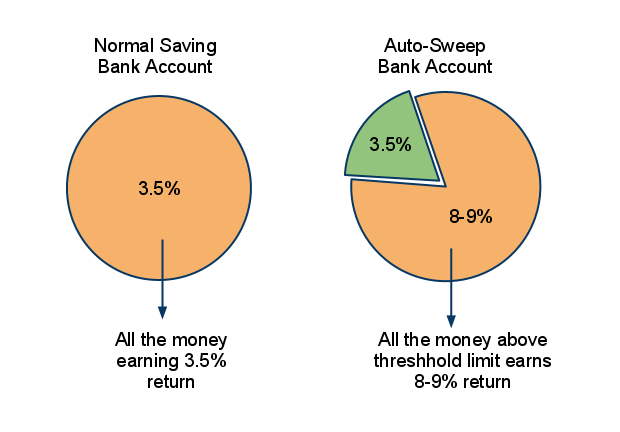

The content available on this linked site is subject to revision, verification and amendment without notice. With an auto-sweep account, your savings account is linked to a fixed-deposit account and a monetary limit is defined. It carries with it the advantage of both facilities. Any action on your part on the basis of the said content is at your own risk and responsibility, and SBG makes no warranty or representation regarding any content provided through this linked site and disclaims all its liabilities in respect thereof. Most commercial banks offer auto-sweep facilities on the SB account in which an auto sweep FD gets linked to your SB account and whatever excess amount you have in the account gets. The auto-sweep facility is a combination of savings account and FD or fixed deposit account. If the said content contains any mistakes, omissions, inaccuracies and typographical errors, etc. are hereby collectively stated as "content" for this linked site. This facilitates automatic transfer of money in multiples of Rs. The information is being provided only for customer convenience and the information, advices, suggestions, illustrations etc. Axis Banks Auto Fixed Deposit links the existing Savings Account to the Fixed Deposit. SBI Finder will enable you to locate the ATMs, CDMs, E-Corners and Branches of State Bank of India, view them on maps and get directions to reach there. But by late Friday the bank said it had fixed the glitch. The Target Market Determination are also available. Copies of historical TMDs for credit card products can be obtained by calling 13 11 55.By clicking on the link "PROCEED" you will be re-directed to a third party website which is neither owned nor controlled nor endorsed in any manner by State Bank Group (SBG). Saving for now, and your future See all your accounts in one place Set a savings goal in the CommBank app with Goal Tracker and make regular (automated). Customers of Chase’s online banking services have seen double transactions, fees and payments in their accounts. Please read the relevant Product Disclosure Statements before you make any decision regarding these products. Any advice has been prepared without taking into account your particular objectives, financial situation or needs, so you should consider whether it is appropriate for you before acting on it. Suncorp Bank is only liable for the banking products or services it provides and not the products and services of the other companies in the Suncorp Group. Products and services including banking and insurance (including home and car insurance) are provided by separate companies in the Suncorp Group. See our Cookie and Data Policy. This policy provides information about how Suncorp collects and uses data related to your online activity, and how you can choose to remain anonymous. The exceeding amount in the multiple of Rs. We use cookies and other related technologies to improve and tailor your website experience. The account holders, throughout the quarter, will have to maintain a minimum balance of Rs. Please ensure that you read these before accessing the site. In accessing Suncorp's site you agree to our Online Terms & Privacy Statement. Registered office: Level 23, 80 Ann Street, Brisbane QLD 4000. © Copyright Suncorp-Metway Ltd ABN 66 010 831 722 AFSL No 229882 Australian Credit Licence 229882 (“Suncorp Bank”). It benefits by making sure that when these two accounts are. To set up either or both of these sweeps, visit a Suncorp branch or log in to Internet Banking and send our team a secure message. Auto sweep is a facility that combines the savings bank account and the fixed deposit scheme.

You can use this to, for example, set an amount you want to keep in your savings account, and then make sure the rest of your money is in your transaction account for you to use. Savings Bank Accounts: In case of Savings Bank Accounts, the auto sweep facility shall operate beyond the minimum balance of Rs 5,000/ and in multiples (units). Insufficient Funds Sweep: if your primary account doesn’t have enough funds to pay for a Direct Debit being withdrawn, or a cheque being cleared, this sweep will automatically take the funds from another nominated account (as long as there’s enough money in there!).įunds Management Sweep: allows you to set a certain balance in an elected account, and then have any excess funds transferred to or from a second account. 50000 to Short Deposit with a minimum of Rs.

It only works if you have at least two Suncorp Bank accounts, but if you do, you can set up either an Insufficient Funds Sweep or a Funds Management Sweep (or both!) Auto/Reverse Sweep with flexibility in threshold and Sweep out amount. By setting up an automatic sweep, you can ensure the funds in your account stay above a certain level at all times.

0 kommentar(er)

0 kommentar(er)