In the last four years, 4 hybrid models have been launched and all met an incredible market demand Then, the hybrid technology was further developed. The process of electrifying Formula 1 cars began in 2009 and was adopted for the first time in the group's sports cars in 2013 with the LaFerrari. Looking at the Ferrari record, we believe that electrification development represents a great opportunity for the future. However, this risk has diminished, thanks to the presentation of the company's electrification plans. As already mentioned, A few Wall Street analysts expressed concerns about the battery electric vehicles transition, which is mandatory in Europe, and this might pose a long-term risk to Ferrari's value.Even today, the lack of semiconductors continues, while the luxury positioning has allowed Ferrari to pay more for the chips, thus ensuring the supply Here at the Lab, we were concerned about the global semiconductor shortage, but Ferrari is now a major beneficiary.To support points 1) and 2), the company will introduce several other new models and unlike other auto manufacturers, we see minimal short-term risk for Ferrari deriving from a drop in consumption or an increase in interest rates.Moreover, the company communicated that the order book is now heading into 2025 Indeed, Ferrari's CEO decided to reopen Purosangue orders which were suspended following unprecedented initial demand. 2023 second half and 2024 will benefit from the entry into production of the Daytona SP3 and the further Purosangue upside.

Ferrari's order book remained resilient in recent years.

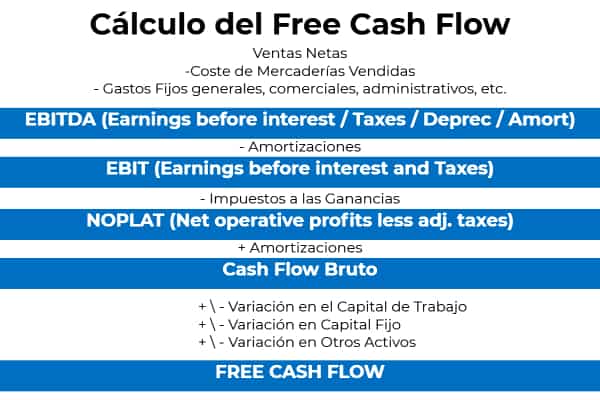

FREE CASH FLOW FORMULA EBIT FREE

In addition, the company is almost debt-free thanks to a solid industrial free cash flow generation (Fig 1) Thanks to the e-fuel new rule, as a result, we decided to reduce the weighted average cost of capital (WACC), which we use in our DCF valuation from 8.5% to 7.5%.Mare Evidence Lab's previous publication Still a buy, why? We are not surprised to see Ferrari's ( NYSE: RACE ) positive stock price performance, indeed, since our last Q1 comment, the company is up by almost 50% (including the dividend payment). Furthermore, we are confident that the recent regulatory change to allow the use of e-Fuel has the potential to mitigate the burden of overheads and reduce the risk on the brand's value. Having said that, we are more optimistic about the auto luxury market, where we see less competitive risk and where we believe the consumer will be also resilient in a period of economic slowdown. Therefore, if the European automotive industry would like to maintain its strong position, it will have to produce products that set new standards in powertrain efficiency. The US giant reported gross margins at 27% in 2022, which is significantly higher than European battery electric vehicle companies, suggesting that the technology gap could be even wider. Well, even if we are supportive of EU OEMs ( Stellantis, Volkswagen, and Renault are all buy-rated), we know that it won't be easy to close the gap with Tesla ( TSLA).

0 kommentar(er)

0 kommentar(er)