PayPal Pay in 4 is a reputable buy now, pay later provider. Loans are paid monthly for six, 12, or up to 24 months Make four payments every second week for six weeks Here are the primary differences between PayPal Pay in 4 and PayPal Credit: PayPal Pay in 4 This is another financing tool that allows you to make bigger purchases.

When checking out, you’ll notice an option to pay with PayPal Credit. PayPal Pay in 4 is not the only pay later option PayPal has to offer These frequent withdrawals can be overwhelming, especially if you’re already in credit card debt. This is because PayPal withdraws money from your bank account every second week. Step 5: Manage Your PurchasesĪfter you’ve made your purchase, head to your PayPal mobile app or website account, and you’ll be able to track your buying history and the dates of future payments.īut I recommend using PayPal Pay in 4 to only make one-time purchases. This allows you to improve and increase your chances of approval next time. If PayPal rejects your purchase, they’ll forward a detailed email letting you know the reason why your purchase was declined. Once you’ve confirmed everything, PayPal takes a few seconds to approve your purchase. You’ll also find the exact date that each payment is due so you can add it to your calendar as a reminder. Step 4: Confirm Your Purchaseīefore completing your purchase, PayPal will present you with a summary of your payments.įor example, if you’re buying something worth $100, PayPal tells you that you’ll pay $25 every two weeks starting today. They’ll start you off with smaller totals, and as you build trust, you can borrow more. You can spend between $30 and $1,500 at once, but it’s rare for PayPal to approve you for $1,500 immediately. If you want to pay off your personal loan over six weeks, click the PayPal Pay in 4 option. Select this button, and you’ll be prompted to log into your PayPal account and choose your shipping address and credit card. Under payment options, you’ll find a PayPal pay later button. So shop like you usually would, and after adding something to your cart, go to checkout. PayPal Pay in 4 typically works with online retailers for one-time purchases. This is to prevent consumers from overusing and abusing the buy now, pay later option. Even if your provider accepts PayPal on their website, PayPal Pay in 4 will rarely approve a recurring bill. The same goes for internet and electricity bills.

You won’t be able to use PayPal Pay in 4 to sign up for services like Netflix, Amazon Prime, or Hulu. A few famous examples include:īut keep in mind that PayPal will reject most recurring subscriptions. PayPal Pay in 4 works with thousands of retailers worldwide. PayPal Pay in 4 is available to shop with at top brands

Who accepts paypal pay in 4 free#

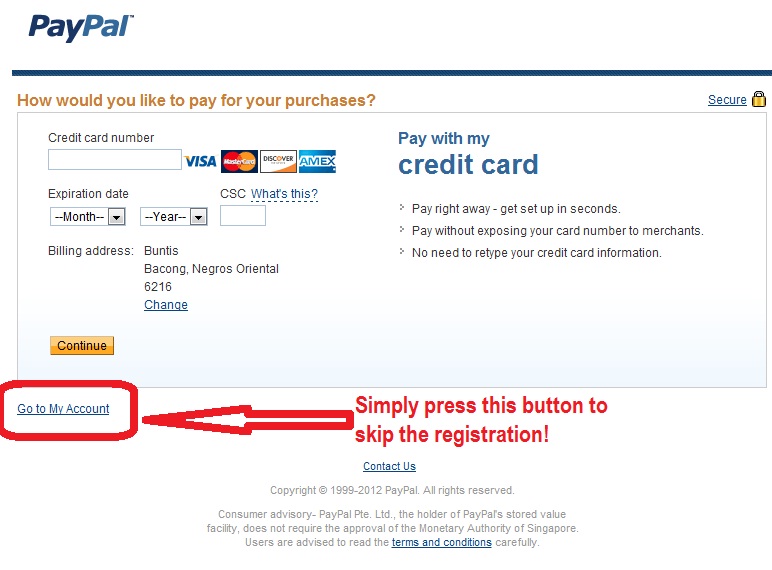

PayPal approves each purchase individually, so once you have an account, feel free to shop around. Unlike other buy now, pay later services, you won’t have to complete an entire application process and confirm your identity. But if you’re new to PayPal, head to, sign up for a free account and link your bank account or credit card. If you already have a PayPal account, skip this step and start shopping at your favorite stores.

Who accepts paypal pay in 4 how to#

So if you’re struggling to qualify for personal loans with bad credit but have a PayPal account in good standing, PayPal Pay in 4 is a handy alternative.Īre you considering using PayPal Pay in 4? Follow this five-step guide on how to use PayPal Pay in 4 responsibly: However, this may change as PayPal is constantly expanding.

You pay the first installment at checkout and the remaining three every second week following. What’s even better is this feature comes without interest or late fees. PayPal Pay in 4 is a buy now pay later (BNPL) service that lets you make purchases between $30 – $1,500 and pay them off in four installments over six weeks. PayPal Pay in 4 user dashboard on the PayPal app makes it easy to track all your payments

0 kommentar(er)

0 kommentar(er)